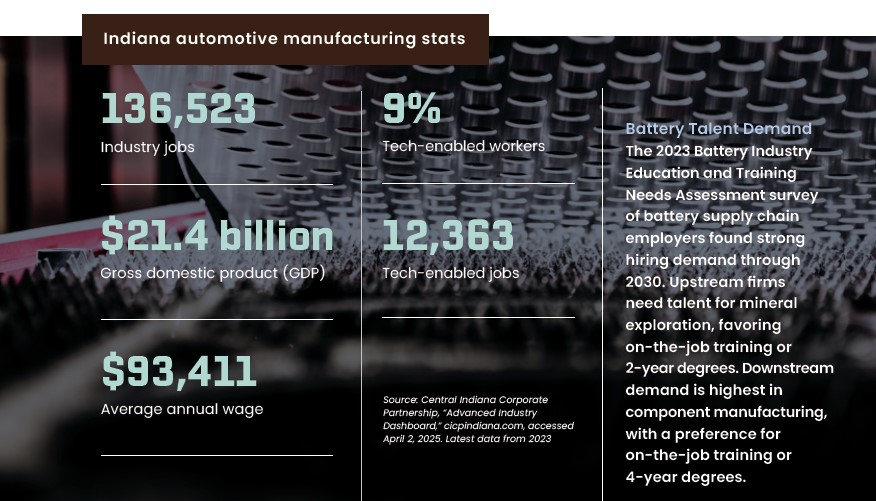

Indiana’s aerospace manufacturing industry may not be the largest among the Indiana has been an automotive powerhouse for more than a century, building on a legacy that stretches from early innovators to today’s global automakers. With more than 136,000 workers and a $21.4 billion contribution to state GDP, the automotive sector is Indiana’s largest manufacturing subsector and one of its most critical.

Today, this industry is at a pivotal moment. As companies strengthen traditional internal combustion engine (ICE) production while simultaneously scaling electric vehicle (EV) and hybrid capabilities, Indiana is taking a multi-track approach that positions the state as both a national leader in legacy manufacturing and a hub for the future of mobility.

The Hybrid and EV Expansion

The past few years have brought unprecedented investment in EV-related projects. More than $12.9 billion has been committed across Indiana to build battery plants, expand EV component manufacturing and prepare facilities for next-generation production. Major automakers, including Toyota, Honda, Subaru and GM, are investing in both ICE and EV operations, ensuring that Indiana remains competitive on a global stage.

This investment is reshaping workforce needs. EV and hybrid vehicle manufacturing requires new technical skills in battery production, software integration and cybersecurity, while still relying on many of the same skills that underpin ICE manufacturing.

Critical Roles for the Future

According to Future Ready: Advancing Indiana’s Productivity through Critical Manufacturing Subsectors, only 9% of Indiana’s automotive workforce is currently in tech-enabled roles—below the state’s aerospace and life sciences sectors. But this share is expected to grow rapidly as automation and data analytics become central to vehicle production.

The study highlights a range of occupations essential to the sector’s evolution:

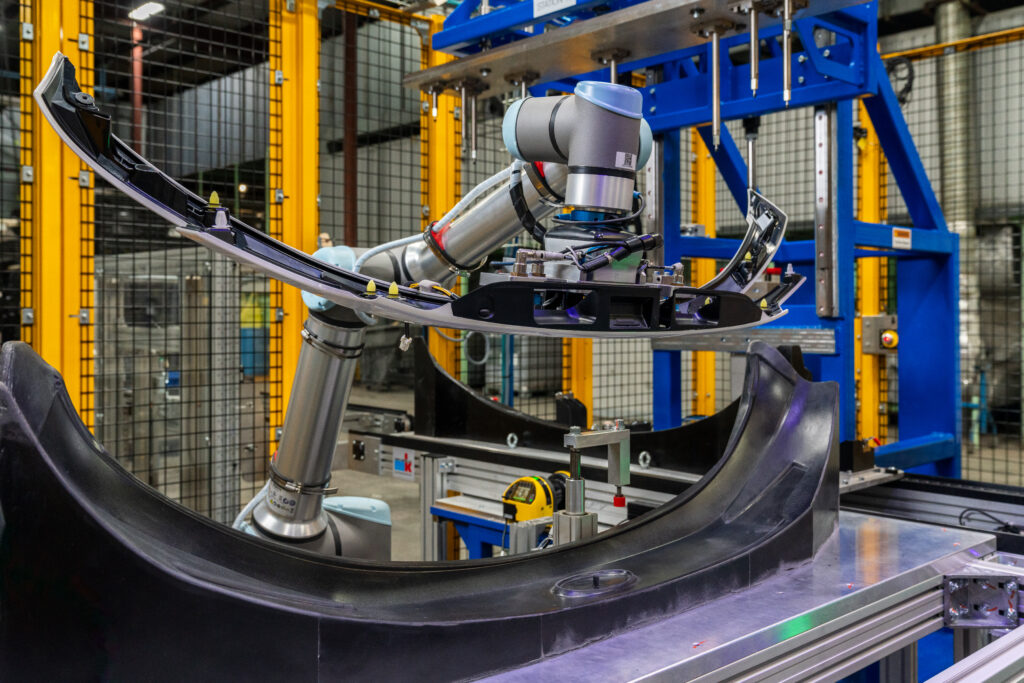

- Most critical roles: robotics engineers, manufacturing engineers, quality engineers and data scientists, all of which support the sector’s shift toward smart manufacturing and EV adoption.

- Critical roles: machinists, welders, press brake operators and quality inspectors remain foundational to production.

This dual demand underscores the importance of both maintaining a strong pipeline of traditional production talent and expanding access to advanced technical training.

Instrumental SME Suppliers

Indiana’s auto sector is defined not just by major original equipment manufacturers (OEMs) but also by its extensive network of Tier 2 and Tier 3 suppliers. These small- and medium-sized companies form the backbone of the industry and many also are investing in automation to reduce costs, increase efficiency and overcome workforce shortages.

The Opportunity

Indiana’s automotive sector is demonstrating remarkable adaptability, maintaining its legacy strengths while preparing for a future defined by electrification and automation. To keep this momentum, continued investment in workforce development and technology adoption will be essential.

View the full Future Ready report to explore the data, trends and workforce strategies shaping Indiana’s aerospace manufacturing sector and how your organization can be part of this momentum.