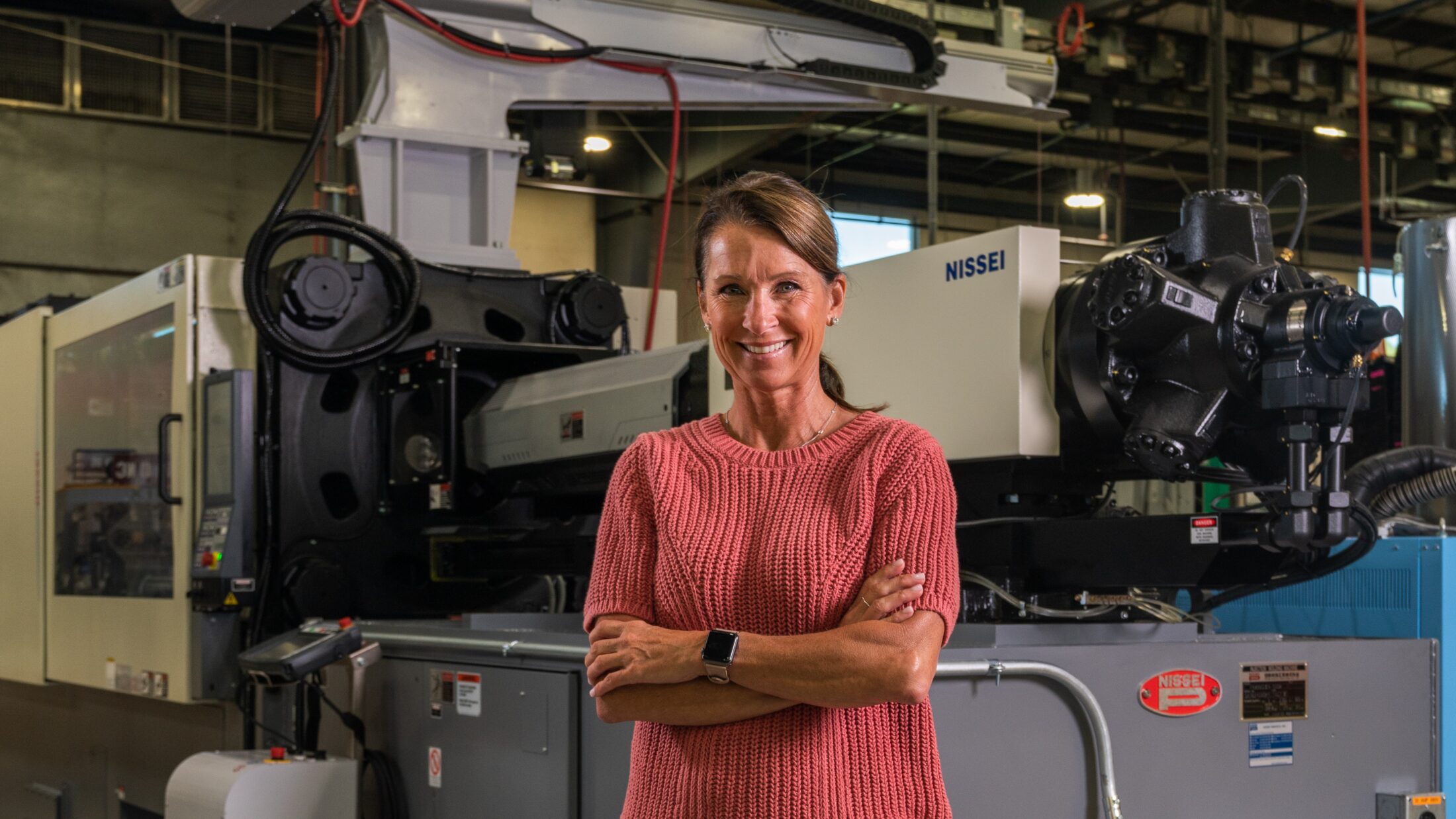

80-year-old company accelerates into EV market with increased automation and a nothing’s-impossible mindset

Mursix Corporation

Key Stats

Re-investment and passion for innovation urge manufacturer into new areas

A one-time low-tech and focused manufacturer has evolved into a high-tech and diverse company by complementing its core capabilities with investments in technology and a willingness to dive into new opportunities.

Mursix Corporation has made a habit of jumping into opportunities while others are assessing the landscape. It was launched 80 years ago as Twoson Tool to produce house-mounted metal hose reels. Today it steps into market gap after market gap with a culture that values innovation, reinvestment and a can-do attitude.

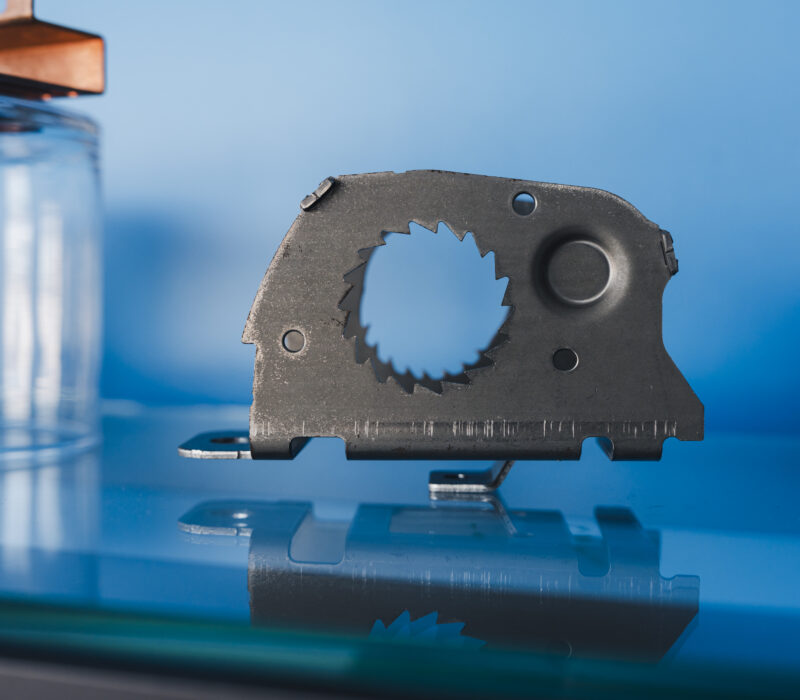

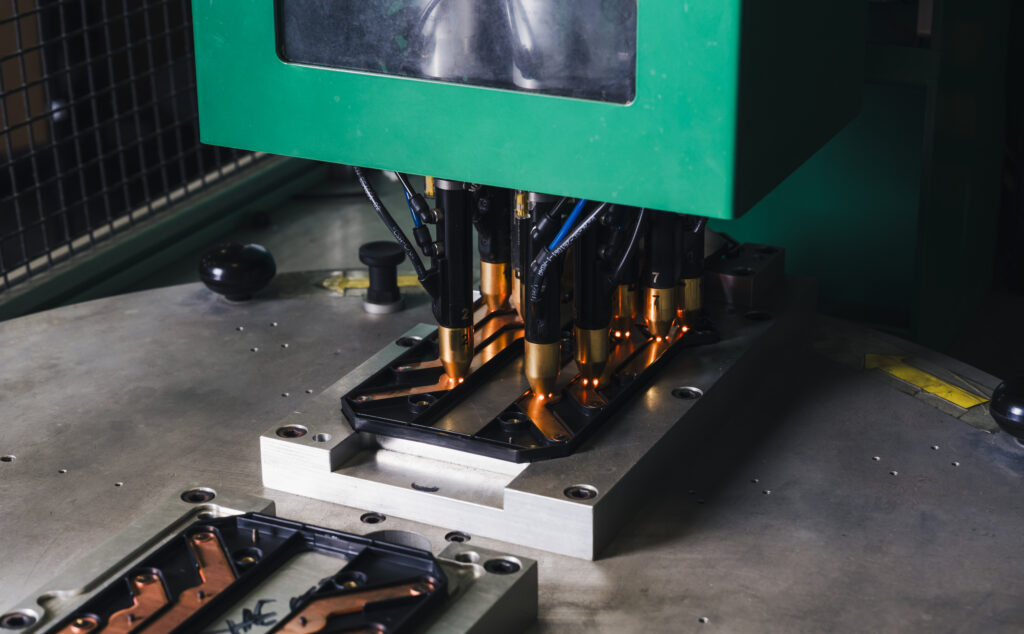

Purchased in 1990 by the Murray family, Yorktown-based Mursix built on its low-tech metal-stamping origin story to become a firm leveraging Industry 4.0 technologies to provide stamping, machining, molding, welding, finishing and prototyping services to automotive, appliance, medical, alternative energy and other industries.

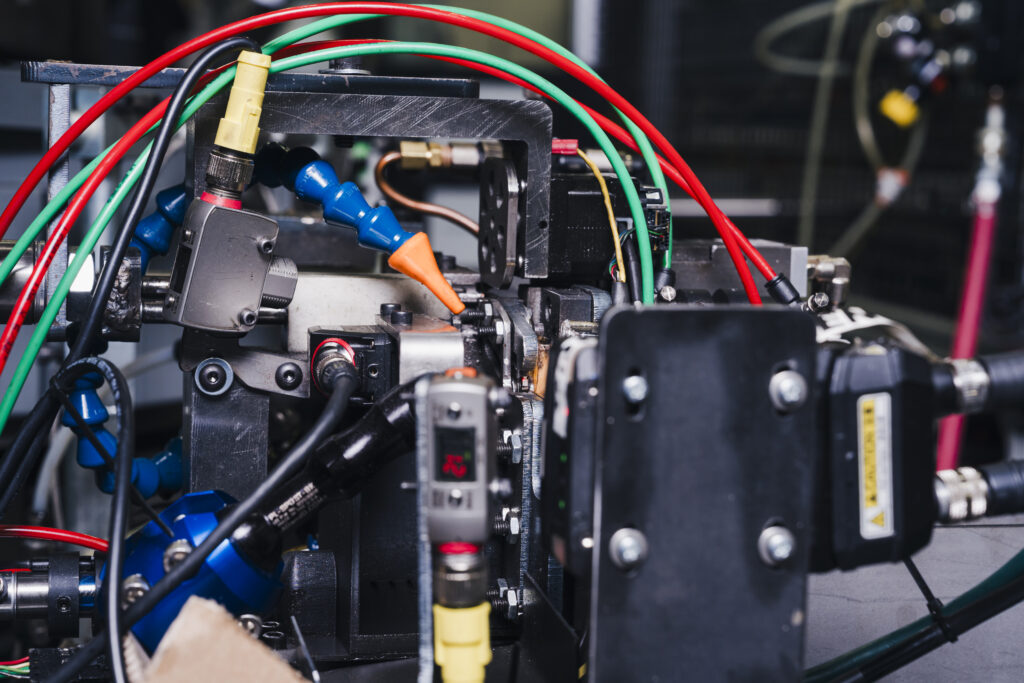

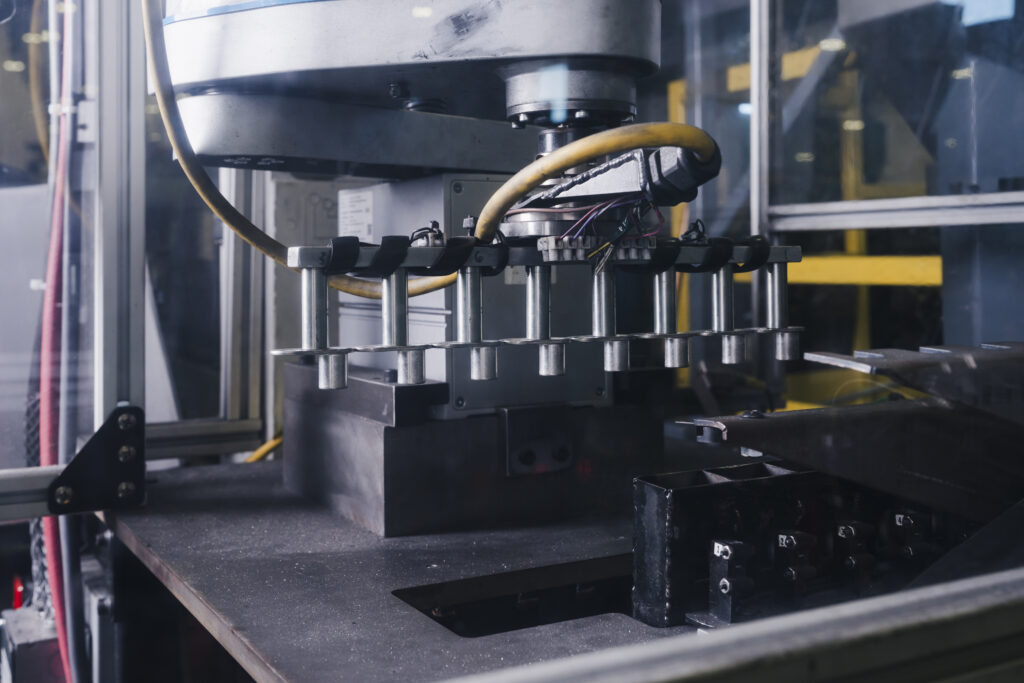

“We’ve grown through a mindset of reinvestment and enhancing our stamping capabilities, getting into a variety of different molding capabilities, like overmolding and injection molding, and then further enhancing these processes with robotic welding and CNC machining,” says Mursix CEO Todd Murray.

“We pride ourselves on our diversity,” adds Mursix Director of Business Development Randy Cremeans. “Technology diversification has allowed us to try and dip our toes into virtually every market.”

Developing additional product areas has sometimes been a result of going against the grain. When the economy went sideways in 2008 and small businesses struggled, Mursix expanded into new markets. When the COVID pandemic slowed business for many firms, Mursix expanded its workforce to supply face shields to healthcare workers. Its team created a product and had it in production in less than a week.

Today the company does about 75% of its business in the automotive category, an industry it finds challenging but rewarding. “If you can do automotive, you can pretty much do anything,” Cremeans says. Still, the company hopes to increase its work in other categories to bring that auto share to less than 50%.

The common denominator across Mursix’s varied categories of work, Cremeans says, is a knack for helping customers envision and efficiently manufacture products. Identifying commonalities among the markets it serves, Mursix asserts its expertise to get its customers from big idea to practical, producible products. With this approach, Mursix has increased its revenue 33 out of the past 35 years.

The key, Murray says, is to believe that they can do anything they put their minds to. “We were always taught there was no such thing as impossible,” Murray says. “Dad beat that into our heads all the time.”

Anticipating opportunity, investing in evolution

Mursix started investigating the EV market more than a decade ago and then began a process of reinvestment and automation that would make it possible to compete in that space.

Ask Randy Cremeans how Mursix got a foothold in the electric vehicle (EV) industry, and he’ll give credit to his boss.

“Around 15 years ago, Todd actually brought it to us and said things are shifting in these kinds of direction and we need to be on the front end of this as much as possible,” he says. Because the company already had been making power-distribution and current-carrying components for the auto industry, it only made sense that the Mursix team should apply its expertise and existing machinery to this budding branch of business.

As far as Mursix leaders could see, the processes involved in generating products for the EV market were mostly the same as the processes they already used in their production lines. Making a few changes in a couple of production steps would open the door to the new business.

However, the team also recognized that they would have to increase their production lines’ automation if they were to compete with lower-cost countries like China and Mexico. So Mursix invested in acquiring knowledge and hiring skilled people who could put together an automated facility with sophisticated equipment while also upgrading existing machinery to increase its press’ tonnage.

“We were able to really kind of just upscale some of our equipment to be able to do it on a bigger scale than what we were doing before,” Cremeans says.

All of this required a capital investment by the Murray family, which owns Mursix, but Cremeans says that was not a problem. “Reinvestment has never been a concern,” he says. “It’s never been hard.” In fact, Cremeans says he occasionally has to tap the brakes on the Murray family’s willingness to make capital injections, slowing the process until the company is ready to put it to good use.

Adding all of this automation and new products would create concern among workers at many companies, but the Mursix team is accustomed to trying new things. The nimble workforce is open to reskilling, Cremeans says, as the company relies on cross-functional teams, helps workers move in new directions and fills knowledge and expertise gaps with new hires.

“Our people have never looked at it as job replacement, but, you know, just job security,” he says. “On the whole it’s more like, ‘Hey, it makes my job easier. Let’s do it because I know you’re going to continue to grow the business and create jobs and create opportunity and upward mobility.’

In that context, Murray is proud to note that the company has avoided layoffs, putting an emphasis on growth and equipping employees for ongoing opportunities.

As it began the process of leaning into the EV market, Mursix was able to draw from existing relationships in the auto industry to acquire or win business. Now it makes inverters and other components for fully electric vehicles and hybrids.

“I feel like our biggest strength has been our reputation with our existing customer base,” Cremeans says. “We end up getting inquiries and recommendations from old contacts we had that were at one company and have moved on to somebody else. They’ll remember us for one of their suppliers for something they need help with, and they’ll recommend us to them.”

Key Learnings: Anticipate, communicate and tap into available resources

Diving into new markets can be risky, but Mursix mitigates some of that risk by staying abreast of industry trends, maintaining low capital risk and keeping its employees in the loop.

While a lot of companies are trying to figure out how to get a piece of the action in the EV marketplace, Mursix has a foothold thanks to a leadership commitment to innovation and a willingness to invest carefully in evolution. To make this work, the company has absorbed a number of lessons, including the following.

Study the marketplace. Fifteen years ago, a lot of people were talking about EVs, but not a lot of people were studying how they might get in on the market. Murray and his team dug in to find out what was going on, where there were opportunities and where their attributes could find traction. As a result, they were ahead of some of their peers, and they continue to look for growing opportunities. “I firmly believe it’s going to be 40% of the [automotive] market share by 2030,” he says. “That’s a lot shorter distance from where it was 15 years ago and where we are today. So there needs to be some energy put into that side of our business to make sure we capitalize on as much of that market share as we can.”

Keep an open mind. If you’re looking to grow in manufacturing, don’t restrict your horizon to the products you currently make. Instead, think about the processes you are good at and how they might apply to new sectors or products. That thinking has allowed Mursix to embrace new opportunities and expand into new areas such as EVs. “At the end of the day, you’re trying to manufacture a product. It doesn’t matter where it’s going, it doesn’t matter what the end use will be,” Cremeans says. “Just maintaining an open mind and being excited by new opportunities — you’ve got to carry that with you every day.”

Utilize existing capital. When trying to expand into a new market, it’s best to start your investment with existing capital to keep cost and risk low. “You just don’t know the acceleration rate of acceptance from the consumer,” Murray says. “Try to utilize existing capital.” This approach allowed Mursix to ease into the EV sector 15 years ago and then dig deeper when it had a better sense of where things were headed.

Tap available resources. Mursix has made effective use of government grant programs to complement its investments in advanced manufacturing technology, which adds to its ability to reduce risk and cost. “Whether it’s local, state or federal, grants are out there,” Murray says. “Keep your ear to the ground and do your best to obtain them. That’s what they’re there for.”

Keep your entire team in the loop. Change — even positive change — can create a lot of anxiety if you don’t let your team know what’s going on. Mursix is dedicated to communicating with all of its employees, from the C-suite to the factory floor, to make sure everyone knows where things are headed. When the company is exploring new opportunities, Cremeans says, the leadership tells the entire team, “Hey, we’re going to dip our toes into something different here. We’re going to give this a shot and here’s why we should be involved.” This openness is consistent with the company’s overall attitude about communication, which includes a belief in open books – sharing financials and profit-loss statements with the entire workforce – and sharing bad news as well as good. This, Cremeans says, builds credibility and prevents the kinds of surprises that can destabilize a team.

Always look ahead. Leaning into the EV market was a result of the Mursix team looking into the future and anticipating the tools and opportunities that lie ahead. It continues to embrace that mindset, most recently by tapping into Murray Mentor, a company spearheaded by Mursix Executive Vice President Susan Murray Carlock to use AI to capture and share the wisdom of experienced employees who are approaching retirement.

“We were always taught there was no such thing as impossible. Dad beat that into our heads all the time.”

Todd Murray

CEO, Mursix Corporation